Taxpayer Bill of Rights. Medical, dental, hospital and veterinary services except those rendered by professionals;. Sale or importation of fertilizers; seeds, seedlings and fingerlings; fish, prawn, livestock and poultry feeds, including ingredients, whether locally produced or imported, used in the manufacture of finished feeds except specialty feeds for race horses, fighting cocks, aquarium fish, zoo animals and other animals considered as pets ;. It supports the third party information program of the Bureau through the cross referencing of third party information from the taxpayers' Summary Lists of Sales and Purchases prescribed to be submitted on a quarterly basis. It is a taxable transaction for VAT purposes, but shall not result in any output tax. If there is no payment: It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines.

| Uploader: | Dur |

| Date Added: | 10 March 2011 |

| File Size: | 61.29 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 60890 |

| Price: | Free* [*Free Regsitration Required] |

Authority to Print Receipt Number at the lower left corner of the invoice or receipt. Published in Manila Bulletin on March 9, In any case, the Commissioner of Internal Revenue may, for administrative reason deny any application for registration.

Manufacture of Chemicals and Chemical Products. Sale or importation of fertilizers; seeds, seedlings and fingerlings; fish, prawn, flrm and poultry feeds, including ingredients, whether locally produced or imported, used in the manufacture of finished feeds except specialty feeds for race horses, fighting cocks, aquarium fish, zoo animals and other animals considered as pets.

Who are required to submit Summary List of Sales?

What are the VAT-exempt transactions? It is a forrm on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. It is an indirect tax, which may be shifted or passed on to the buyer, transferee or lessee of goods, properties or services.

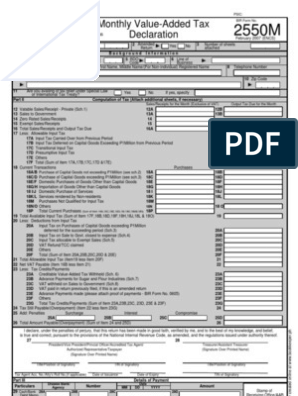

BIR Form No. 2550M Monthly Value-Added Tax Declaration

Failure to file a value-added-tax return as required under Section ; or. Published in 25500m Bulletin on December 29, The following transactions are considered as deemed sales: Clarifying the provisions of Republic Act No.

Shareholders or investors as share in the profits of the VAT-registered person; or.

Radio, television, satellite transmission and cable television time. Insurance and Pension Funding. The lease of motion picture films, films, 2550n and discs; and. Promulgates the requirements for the maintenance, retention and submission of electronic records. Does amortization of input VAT still allowable?

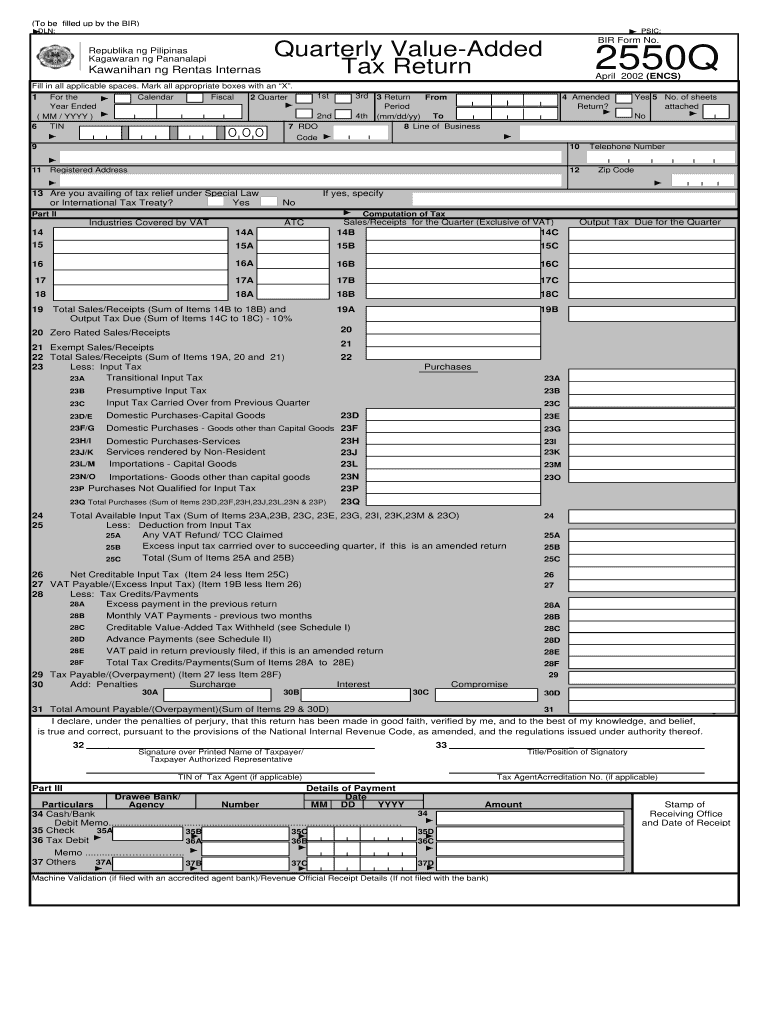

Value-Added Tax - Bureau of Internal Revenue

Services rendered by individuals pursuant to an employer-employee relationship. Prescribes the effectivity of threshold amounts for sale of residential lot, sale of house and lot, lease of residential unit and sale or lease of goods or properties or performance of services covered by Section PQ and V of the Tax Code ofas amended.

Output tax means the VAT due on the sale, lease 250m exchange of taxable goods or properties or services by any person registered or required to register under Section of the Tax Code. Clarifies the coverage of RMO No. Services rendered to persons engaged in international shipping or air transport operations, including leases of property for use thereof; Provided, that these services shall be exclusively for international shipping or air transport operations.

Prescribes the tax treatment of sale of jewelry, gold and other metallic minerals to a non-resident alien individual not engaged in trade or business within the Philippines or to a non-resident foreign corporation.

Sale of power or fuel generated through renewable sources of energy such as, but not limited to, biomass, solar, wind, hydropower, geothermal and steam, ocean energy, and other shipping sources using technologies such as fuel cells and hydrogen fuels; Provided, however that zero-rating shall apply strictly to the sale of power or fuel generated 2505m renewable sources 2550, energy, and shall not extend to the sale of services related to the maintenance or operation of plants generating said power.

If he has ceased to carry on his trade or business, and does not expect to recommence any trade or business within the next twelve 12 months.

Value-Added Tax

The supply of any assistance that is ancillary and subsidiary to and is furnished as a means of enabling the application or enjoyment of any such property, or right or any such knowledge or information. Amends further RR No. Any person who elects to register gir optional registration shall not be allowed to cancel his registration for the next three 3 years.

Creditable Input Tax k. Prescribes the policies and guidelines biir the monitoring of service fees of professionals Published in Manila Bulletin on March 21, Digest Rorm Text. Transfer of property in merger or consolidation pursuant to Section 40 C 2 of the Tax Code, as amended.

Sale of real properties utilized for specialized housing as defined under RA No. The Commissioner or his authorized representative is empowered to suspend the business operations and temporarily close the business establishment of any person for any of the following violations: What transactions are considered as zero-rated sales?

Комментарии

Отправить комментарий